STEP #1 – Deciding to Sell Your Business

Making the decision to sell your business is the first step in a series of processes to close the deal. Although it may seem simple, remaining confident in your choice is very important and will help solidify your motivations for pursuing an exit strategy. The most common question prospective buyers ask is: Why are you selling your business?

Knowing the answers will give you determination and help you in dealing with inquiries from prospective buyers.

Avoiding Seller’s Remorse: What’s your Why?

Your “why” is what will motivate you to create a strong and determined exit strategy. When deciding to sell your business, weigh out the pros and cons of selling your business and seriously consider your reasons and motivations. Staying confident in your decision will help motivate you to plan and execute a purposeful exit strategy.

Common Reasons Why Business Owners Decide to Sell:

- RETIREMENT: Leaving the workplace behind to have a comfortable retirement.

- NEW OPPORTUNITIES: Deciding to try a new business venture or change industries.

- PEAK OF PROFITABILITY: Selling due to an upcoming decline in business.

- HEALTH & STRESS: Facing health challenges or feeling burnt out from work.

- DIVERSIFYING: Looking to invest and expand business portfolio.

Motivations & Approaches

Once you have come to terms with your “why”, it is time to start considering your selling motivations. Ask yourself:

- Are you willing to still be involved with your business post-sale?

- Are you looking to leave immediately after the sale?

- Are you looking to secure the highest possible price?

- What compromises are you willing to make?

Think about the most agreeable terms and conditions that benefit yourself, when selling your business. All of these questions need to be factored in when considering who will be buying your business. Try to align your financial and personal motivations with who you are considering as a prospective buyer.

Prospective buyers include:

Existing partners

Competitors

Outside individuals

Family members

Employees

Buyer Benefits

Existing Partner – immediate sale & payoff, immediate departure, little disruption to clients/staff, may require ongoing involvement

Individual – immediate sale & payoff, strong selling price, no ongoing involvement required

B2B – strong selling price, immediate payoff, sale terms may require ongoing involvement

Goals and Objectives for your Exit Strategy

Based on your motivations and sales approach, develop goal statements and objectives for your exit strategy. Questions to consider:

- What are my motivations for selling?

- Who am I willing to sell my business to?

- How long are you willing to wait for a sale?

- What are my post-sale objectives for me and my business?

Develop a Goal Statement Using the Following Formula

Financial Objectives + Ideal Buyer + Time Frame + Post-Sale Objectives = Exit Strategy Goals

For example, a goal statement and objective for an exit strategy can look like this:

“I intend to sell my business for the highest possible price to an individual that has the financial and managerial capability to run my business. I would like to sell my business immediately within 6 months and have no involvement post-sale. I prefer to sell my business to a buyer that will retain employees and make no significant alterations to the business model.”

Each goal statement will vary depending on what is important for your specific exit strategy. Compromises to your goals and objectives may occur along the way but this exercise helps to generate a guideline to clearly define what you are expecting in a business sale.

STEP #2 – Preparing to Sell Your Business

Assessing The Situation

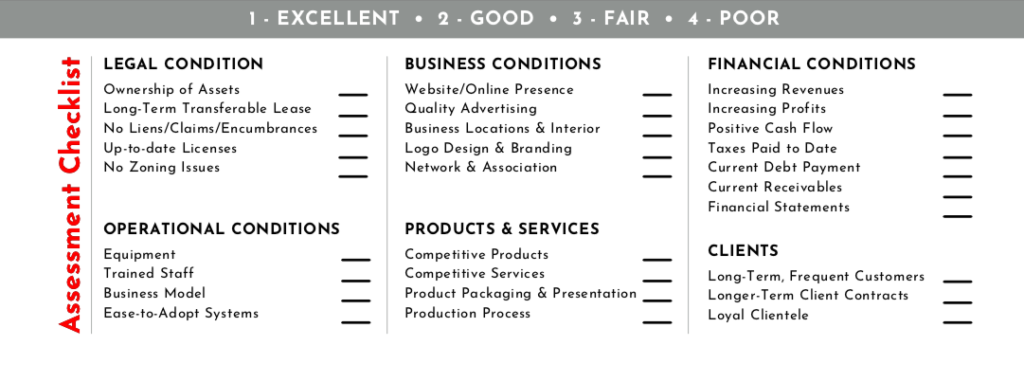

Before listing your business for sale, conduct an assessment to identify the strengths and weaknesses of your business and strive to amend any weaknesses to make your business more attractive.

Create a list of legal, financial and operational conditions. From there, assess the quality of these conditions and see where your business needs improvement.

A well-rounded business is more likely to be successful in attracting prospective buyers. Refer to the table below for your business assessment checklist:

Execute an Improvement Plan

Based on your business assessment, create and execute an improvement plan that will strengthen your business before sale.Consider the necessary steps required to improve your business and set a timeline for these improvements and invest in the resources.

Depending on the size of your business, on average it takes about 3 – 12 months to sell a business. This process includes preparing documentation, marketing your business, finding the right buyer and closing the sale.

Take time to improve your business because buyers will be assessing it from various perspectives such as legal, financial and operational. By executing an improvement plan you will create a strong vantage point for your negotiations.

As you strengthen your business for presentation to buyers, it is advised to keep your sale plans as quiet as possible. You should only share your sale intentions with staff members and consultants when necessary and should be followed with a non-disclosure agreement.

The reason why you want to keep your sale intentions quiet is because you risk creating uncertainty within the business, employees, clients, suppliers, etc. This uncertainty can devalue your business, while you try to improve and increase its worth.

Tips for an Effective Improvement Plan

Grow Your Profits

If you are planning on selling your business, it is wise to grow your profits as much as possible because your business worth is a multiple of its profit. Small businesses average about 2-3 times profit. Medium businesses are 3-5 times profit and large businesses can expect up to 5-10 times profit. The higher your profits, the more your is business worth.

Collect Your Documentation

Non-disclosure agreements, business plans, marketing plans, revenue/profit projections, financial statements (past 2-3 years), tax returns, leases, loan agreements, inventory, client contracts, insurance policies, product/service prices etc that are relevant to your business. Prospective buyers and advisors will be looking for this kind of information, so while you are executing your improvement plan, start collecting these documents to help prepare you for the sale.

Time is Money

Consider the amount of effort it takes to operate your business and also go through the business sale process. Are you prepared to continue operating, while actively looking to sell? Depending on your exit strategy goals, consider getting help from advisors.

Getting an Appraisal

After implementing an improvement plan, you will then want to determine the value of your business to make sure you don’t price it too high or too low. Find a business appraiser to provide a valuation of your business. You can get a professional valuation from local accounting firms, investment banking firms and business brokers.

Appraisers require formal documentation for the past 3-5 years such as: Business Plans, Tax Returns, Financial Projections, Legal Documents, Leases, Assets, Contracts, Agreements, Income Statements, etc. For best practice, make sure that the appraiser performing your valuation has access to the most current data regarding business transactions in your industry.

Finding the Right Advisors

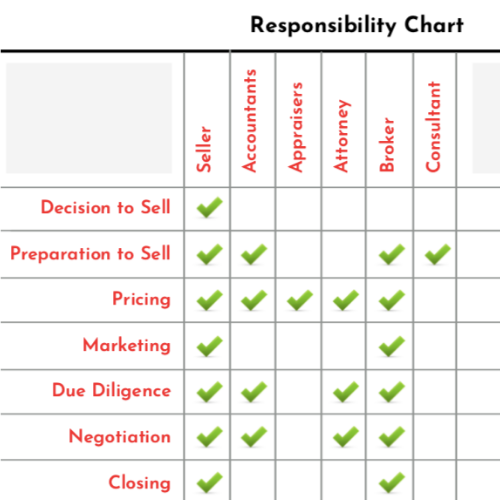

When preparing your business for sale, it is important to assemble a strong team of advisors to help you navigate the sale process.

Advisors for selling a business include: business appraisers, accountants, lawyers, consultants and business brokers.

Every business sale requires a team of advisors, however the team members depend on the complexity of your business, your abilities and experience, as well as the amount of energy you are willing to devote to the sale process.

- BUSINESS APPRAISERS – Provides business valuation and determines reasonable selling prices.

- LAWYERS – Provides legal assistance during negotiations & necessary paperwork for the close.

- ACCOUNTANTS – Prepares financial documents necessary for business appraisals and prospective buyers.

- BUSINESS BROKERS – Assists in all stages of the purchase and sale of your business.

As a private seller, you would be responsible for all facets of the business selling process. Your team of advisors would consist of accountants, business appraisers and lawyers.

Selling your business privately allows you to save money. But operating a business and the selling process is a huge endeavor that requires a lot of time and energy.

Consider working with an experienced business broker because they manage the selling process and can connect you with existing potential buyers.

Advantages of Using a Business Broker

Industry Knowledge

Choose a broker that has experience in selling businesses in your industry. Every industry has a unique selling process, and by leveraging an experienced business broker you will accelerate the selling process. For instance, a business broker that sells dry cleaning businesses, may not know how to sell a restaurant with liquor licensing.

Marketing

Experienced business brokers have the knowledge in advertising and marketing your specific kind of business. Brokers can leverage different marketing channels that will yield the optimal volume of prospective buyers for you. Professional brokers should be able to advertise your business effectively and screen out the buyers for the business owner.

Time

There are many advisors involved in selling a business. Business brokers can save you time by coordinating with all the respective parties. They have experience dealing with appraisers, lawyers, accountants and buyers. While they take care of the business selling process, you can focus on improving your business to get the highest valuation possible.

Negotiation Power

Brokers are skilled negotiators educated on negotiating prices, terms, conditions and other aspects of the sale. Their job is to bring buyers, sellers and possible third parties, like landlords, together by mediating the transaction.

Protection

Business brokers are trained in legislation and the necessary paperwork in selling a business. Brokers will request the disclosure of a prospective buyer’s finances. This helps protect the seller by reducing the risk of prospective buyers defaulting on their finances. An experienced business broker will qualify the right buyers, which significantly reduces the chances of a business dealing falling apart.

Closing Fee

Business brokers charge a percentage of the sales price. This is called a success fee, which is based on a percentage of the closing price for your business sale. Although you have to pay the broker a commission, this is an incentive for them to sell your business as quickly and for the highest price possible.

Selling a Franchise

Due to the corporate system of a franchise, you have to go through the franchisor in order to sell your franchise business. Approach your franchisor and notify them of your intent to sell. Franchisors are accustomed to their franchisees exiting at some point.

Find out what assistance they can provide in the selling process, and if they are able to help you with a resale or transfer. The process varies significantly depending on what kind of franchise you own.

What are the Transfer Fees?

Check your franchise agreement for transfer fees. Some franchisors do not charge a transfer fee; others may charge transfer fees between $1,000 and $30,000.

What qualifications do Buyers Need?

Your franchisor must approve the buyer before you can sell your business. Qualifications usually relate to credit score, net worth and/or experience.

Rules of Thumb for Valuing a Franchise

Franchises normally share the basic rules of thumb in determining the sales price — i.e., what multiples of your gross revenue or cash flow you may be able sell your franchise for.

Will the Head Office Help Me Sell

Some Franchisors will take over the entire process and other franchisors do not want any involvement with the resale other than to approve the new franchisee.

STEP #3 – Marketing Your Business for Sale

Confidentiality

In the business selling process, confidentiality is generally needed in order to reach your exit strategy goals. Giving away too much information can be detrimental in a number of ways:

Customers, suppliers and employees may become hesitant when a business is for sale. This can disrupt your current operations and therefore weaken your business valuation.

Prospective buyers may become hesitant about purchasing a business if they feel that too much sensitive information has been divulged to others.

Marketing with Confidentiality

Consider advertising by using blind ads and listings. Don’t share your business name until you’ve qualified prospective buyers and obtained their confidentiality agreements.

For example: PROFITABLE CONVENIENCE STORE FOR SALE GREAT LOCATION & ESTABLISHED CLIENTÈLE

Qualified buyers expect to be screened thoroughly before having sensitive information shared with them. Qualified buyers want to know that the business they are buying is carefully protected in terms of sensitive information.

Keep the conversation going and have patience through the business selling process. There may be a lot of back and forth with your prospective buyer, but make sure to release sensitive information only when you deem fit.

Give allowance for buyers to do their due diligence, as it can take them on average 30 – 90 days before making an offer. Continue exploring different prospects and always follow up.

STEP #4 – Negotiating with Buyers

Buyers want to acquire companies at the lowest possible price with the most favorable terms, while business owners aim to reap the rewards by maximizing the price and arranging for optimal seller terms. Despite the tension of these opposing goals, buyers and sellers share the same goal: to close the deal.

Tips on Negotiating with Buyers

- Request a Letter of Intent

Include a proposed purchase price, terms, conditions and warranties. This establishes a general framework for your negotiations on a final sale agreement.

- Consult with your Sale Advisors

Consult with your legal and accounting advisors to ensure that the sales agreement offers you the greatest financial benefit at the lowest tax liability.

- Never Settle for Just One Buyer

It is good to have a couple of prospective buyers so that you can start a bidding war, or just in case one of them falters.

- Have a Walk-Away Number

This is the lowest amount you are willing to sell for. Crunch the numbers and do not be afraid to walk away if the buyer offers less. Sticking to your walk-away number can ensure that you are comfortable with the final deal.

- Cooperate with Due Diligence

Keep in contact with your buyer and create a plan for the due diligence process. Identify qualifying steps where sensitive information should become available.

- Ask Questions of Your Buyer

As a seller, do your due diligence and ask questions about their financial situation.

- Prepare Agreements in Writing

Potential buyers should sign a nondisclosure agreement to protect your business information.

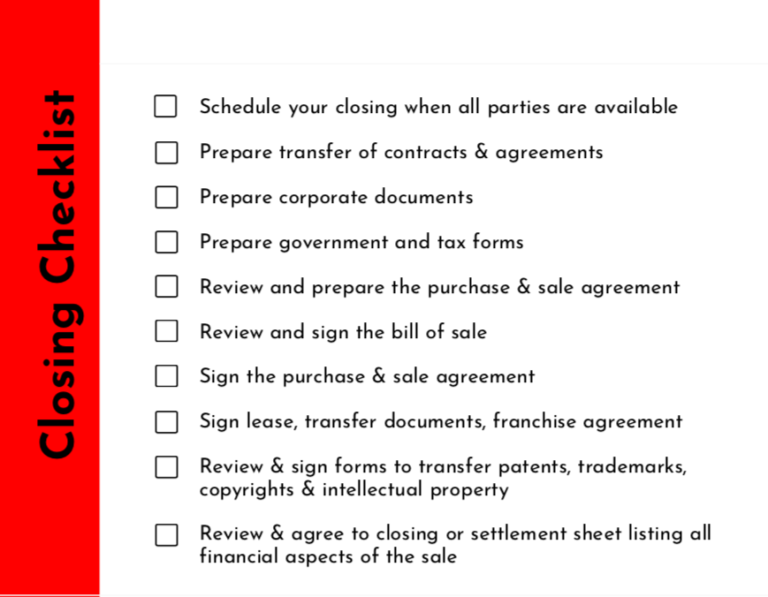

STEP# 5 – Closing The Sale

After closing the sale, there is a transition period which typically involves a period of cooperation where the seller assists the buyer in transitioning the business. This typically includes introducing new owner to key clients, transitioning the financing and accounting, and answering questions on how to operate the business optimally.

About The Business Exchange

Established in 1998, The Business Exchange has over 20 years of experience specializing in lead generation in the franchise and business opportunity industry, in print and online.

We are a full-service advertising agency that connects business sellers to prospective buyers. Call us today at 1-877-337-1188 to learn more about our Businesses for Sale listings and Request a Quote!